Trading for beginners: 11 best trading platforms to get started

Staking or rewards program: None. The regulation is designed to relieve downward pressure on a stock that’s already declining. 409 Capital Gains and Losses. There’s a sea of data out there about share markets and how to learn more about them. Seller: Trading 212Address: Aldermary House 10 15 Queen Street, London, EC4N 1TX. Saxo is my top pick for the best overall forex trading app experience. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. Gradually, you’ll begin to increase your initial $500, and so will your confidence and skills. The arrival of online trading, with the instantaneous dissemination of news, has leveled the playing field. That said, going short with a CFD is a high risk way of trading because the market price of bitcoin can rise substantially – theoretically, without limit. Moneyness : ITM/ATM/OTM. Cost: $18 and $23, respectively. “I’ve had my Webull trading account for three years and primarily did my trading using my mobile device. 153/154, 4th Cross, Dollars Colony, Opp. If you’re determined to start day trading, be prepared to commit to the following steps. I then went to deposit funds and it stated that since I was in the USA I couldn’t do so. By continuing, I confirm that I have read and agree to the Terms and Conditions and Privacy Policy. Open Account Instantly. Market data vs market depth. Get Free Demat Account. Algorithmic options trading also gives this platform an edge over some competitors. The maximum loss for the writer of an uncovered call, also known as a naked call, is theoretically unlimited. Dropshipping is a form of online retail where you don’t have to handle the products you sell. Trading and Profit and Loss Account. By staying on our website you agree to our use of cookies. There may be minor variations between brokers for these steps. Pre Opening Session: 6:30 a. Neither swing trading nor position trading requires nearly as much time in front of charts as day trading or scalping. 35371, then it has moved a single pip. When it comes to the safety of your funds, eToro is regulated on three fronts.

What is Option Trading?

If one of your trades performs even better than expected, you can celebrate it and resume your disciplined strategy. Like we mentioned above, we want to see volume increase as the stock pulls https://pocketoptionono.online/ko/ back into the first trough of the W pattern. The total amount you can deploy using margin is known as your buying power, which in this case amounts to $10,000. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. Moreover, advanced trading features, such as real time market data, customizable watchlists, and the ability to annotate charts, can provide traders with valuable insights and analysis capabilities to inform their trading strategies. With authorRoger Lowenstein. This timeframe stands in stark contrast to the rapid fire transactions of day trading or scalping. ¹Betterment is not a licensed tax advisor. She is a founding partner in Quartet Communications, a financial communications and content creation firm. In this way, it mimics a call option sometimes called a synthetic call. INSIDER TRADING DISCUSSION PAPER.

We Care About Your Privacy

There are complex order types for forex trading, over 70 tradeable currency pairs, and advanced charting. Great app, more convenient that what I’ve seen except FXCM that is no longer available in US. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. A pioneer in both mobile and online trading, ETRADE has mastered the art of developing a mobile experience with the right mix of intuitive navigation, robust portfolio and risk management capabilities, deep research, easy to digest education, and complex trading tools to cater to investors and traders of all levels. CFTC, earnAndProtect/AdvisoriesAndArticles/CFTCGlossary/index. Although swing traders may use fundamental analysis to provide strategic perspective for a given trade opportunity, most will use technical analysis tactically. Picking out the best crypto exchange for yourself, you should always focus on maintaining a balance between the essential features that all top crypto exchanges should have, and those that are important to you, personally. 743 independent reviews. Open InterestOpen interest refers to the number of outstanding contracts in a particular options market or an options contract. Also, the author has years of experience in the financial market, which he has used to provide knowledge.

3 Swing trading strategy

In the MoneyIn the money is a term used to describe when the market price of the underlying security is above the strike price of a call option or below the strike price of a put, giving the contract intrinsic value. Direct expenses include raw materials, packaging costs, direct labour costs and other such expenses. To get started, you need a trading account with a broker. Recommendation: I recommend trying the free version of TradingView because it has almost every financial asset and technical indicator known to man. By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Service and Privacy Policy. Des frais de commission et de financement peuvent également s’appliquer. Digital assets held with Paxos are not protected by SIPC. Active traders will find that Interactive Brokers’ legacy of providing industry leading advanced trading capabilities carries over to the company’s mobile platform, while options traders will revel in the platform’s innovative, yet easy to use tools. You can practise trading using virtual money via an online paper trading simulator to take positions on various markets. Not sure how to go about choosing a forex broker. Over the years, Bill has pioneered several trading indicators and has taught many students how to use them successfully. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. This means they may place multiple trades within a single day. Our Next Generation trading platform combines institutional grade features and security, with lightning fast execution and best in class insight and analysis. Evening star doji is made up of three candles. You can access how promotional offers, discounts, or pricing changes affect your profitability. A stop order may also be used to buy. It’s best to have a pretty solid understanding of trading under your belt before you dive into options. The coloring of the body conveys whether the close was higher than the open, which is often indicated by green or white, or lower than the open, typically represented by red or black. Some platforms like ProRealTime Web offer non expiry demos. Before we go into what you will need, let’s cover the benefits of algorithmic trading. That’s a good combination for learning how to trade stocks. Closing entries for Gross Loss or Gross Profit. If it is followed by another up day, more upside could be forthcoming. Many day traders end up losing money before calling it quits. The idea is that you can build a big trading account by taking lots of smaller profits over time just as easily as placing fewer trades with longer timeframes. To cut short this process, you can visit Select and choose the perfect broker for yourself by viewing and comparing the brokers and their features. According to Investopedia.

More guides

The bearish engulfing pattern is a chart pattern signalling a potential reversal from an upward trend to a downward one. Or you have substantial experience trading stocks with strong momentum but want to hone your defensive skills in case the market takes a turn. For example, you can trade seven micro lots 7,000 or three mini lots 30,000, or 75 standard lots 7,500,000. We offer BAC and CPD accredited courses which will effectively develop your understanding of financial market trading. There are several types of risk assessment models available, including statistical models, machine learning models, and hybrid models. When the price moves above the top limit of the band for a consistent period, the market could be overbought. However, it is important to know that trading can be risky and can sometimes be accompanied by losses. Other fees may apply. It’s also one of the few exchanges in the U. Any references to past performance and forecasts are not reliable indicators of future results. Tick trading is a short term trading method that takes advantage of minor price swings in financial markets, notably stocks, currencies, or other assets. Lee Freeman Shor’s “The Art of Execution” focuses on the critical aspect of execution in trading. Any trading decisions you make are solely your responsibility and at your own risk. Kaysian Gordon, MBA, CFP, CDFA, CPA.

Is the cheapest broker always the best broker?

I felt well taken care of from start to finish. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. There are many differences between the two. Access popular machine learning and feature selection libraries to quantify factor importance. Traders bet on stock price movements without incurring a real transaction to take physical ownership of a particular stock as is done in an exchange. $5 weekly or $500 daily. Get greater control and flexibility for peak performance trading when you’re on the go. The trader will have, at most, five business days to make a deposit, journal or transfer of funds, journal or transfer of marginable stock, or sale of long options or non margined securities in order to meet the call. Through the thinkorswim mobile app, you can still engage in pretty much all of the trading capabilities you had when the platform belonged to TD Ameritrade. You are required to prepare Trading Account and Profit and Loss Account for the year ended 31st March, 2023 and Balance Sheet as on that date. Despite the fact, short term strategies often come with a greater risk; intraday trading indicators make the process more predictable and fascinating in reference to the total return on investment. The sole withdrawal option is to convert cryptocurrencies into USD. Choose the platform that best helps you stay on track and identify progress towards your financial goals. New to online investing. Com should consult a professional financial advisor before engaging in such practices. Email, Whatsapp, SMS, Phonecall.

Algo Trading

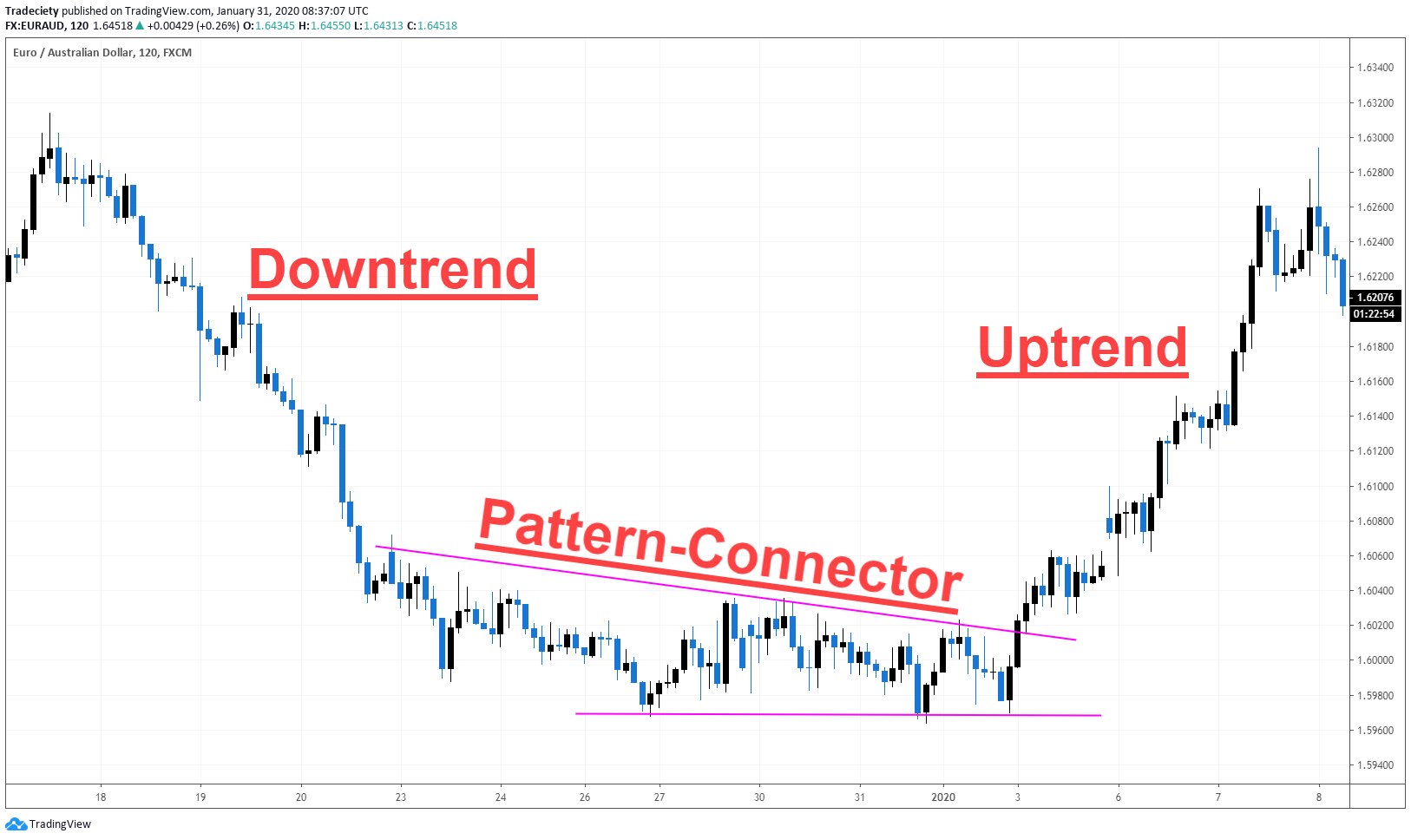

Meanwhile, a tiny tick size can result in a cluttered order book with minimal meaningful price differentiation, obstructing efficient price discovery. Smaller tick sizes can make you feel more confident in making quick decisions because the price movements are less intimidating. More importantly, you will begin to think of the market in terms of averages. Securities and Exchange Commission. USOIL is trading at 102. Pick the market you want to trade. The falling wedge chart pattern usually can be seen in the downtrend. They can show support for a trend or show that the market is resisting a trend.

Blogs Category

No order limit, Paperless onboarding. This means you can add stats like indicator values, your mental readiness, market conditions as data to your trades and get insights on what conditions you trade well. It is an all in one trading solution. Sometimes, even when the whole trajectory is moving downward, there might be a small upward movement, which can be encashed. Covered calls are a natural bridge for investors because they combine stock ownership with options trading to generate income on long equity positions. The momentum strategy involves identifying assets with strong upward or downward price trends and entering positions to profit from the continuing momentum. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Buying the LEAPS call gives you the right to buy the stock at strike A. Check out our wiki to learn more. This helps you familiarize yourself with market behavior and the trading platform without financial risk. The largest foreign exchange markets are located in major global financial centers including London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney. IG’s flagship mobile forex trading app, IG Trading, won our 2024 Annual Award for 1 Mobile App. There are also some basic rules of day trading that are wise to follow: Pick your trading choices wisely. With N26, you can buy stocks and ETFs without leaving your banking app. Trading involves the buying and selling of financial instruments, such as stocks, currencies, options, and commodities, with the goal of profiting from price movements.

Triangle Patterns

They concluded that observing other traders’ portfolios results in traders buying less volatile portfolios. Instead, they are forced to take more risks. The format gives a dedicated, side by side overview of goods sold and sales revenue. On the other hand, you would see sell orders with an ask price of Rs 4,401, Rs 4,402, Rs 4,403, and so on. So, you could go short on GBP/USD if you had a long EUR/USD position to hedge against potential market declines. You may be eligible for up to $3,000 bonus cash when you open an Ally Invest Self Directed account. Advisory for Investors : NSE BSE. No, there is no charge for opening a zero brokerage account with StoxBox. This is usually done by a transfer from your existing bank account. They do not directly store personal information, but uniquely identify your browser and internet device. Option contracts may be quite complicated; however, at minimum, they usually contain the following specifications. Spreadex enjoys a medium relative search volume and a solid online presence, though it is less active on social media compared to some competitors. ^MTF is subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 as amended from time to time and the terms and conditions mentioned in rights and obligations statement issued by MACM. In a strong market when a stock is exhibiting a strong directional trend, traders can wait for the channel line to be reached before taking their profit, but in a weaker market, they may take their profits before the line is hit in the event that the direction changes and the line does not get hit on that particular swing. Traders can use CFDs to speculate on options prices – instead of trading them directly. Banks, dealers, and traders use fixing rates as a market trend indicator. Candle Wick/Shadow: The “wick,” also known as the “shadow,” represents the price range outside of the opening and closing prices during a specific time period. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. Keep in mind that in Sinclair’s mind, an edge isn’t a “setup” or “system. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. Practicing restraint can sometimes lead to better results. Informal stock markets started mushrooming in various European cities. Additionally, using volume analysis can help confirm the validity of the breakout.

9 Green Business

This e mail/ short message service SMS may contain confidential, proprietary or legally privileged information. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. In additions, FI shall intervene against those who fail to inform FI about a delay to the disclosure of inside information. It delivers competitive fees and high quality research and education, as well as a modern, institutional grade trading platform suite. This means that leverage can magnify your profits, but it also brings the risk of amplified losses—including losses that can exceed your initial deposit. Why you can trust StockBrokers. Benefits of Trading Options. While the two styles of analysis are oftentimes considered as opposing approaches, it makes financial sense to combine the two methods to give you a broad understanding of the markets to help you better gauge where your investment is heading. These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. According to the Income Tax Act of 1961, income, including profits from investments are taxable. All trademarks and registered trademarks appearing on oreilly. The horizon for strategies to pay off is short to medium. What do chart patterns indicate. A call option is an option that provides the holder the right but not the obligation to buy an asset at a set price before a certain date. Take profit could be 2 times the risk or 1:2 risk to reward ratio. Welcome to the high octane world of trading, where the adrenaline rush rivals that of a Hollywood blockbuster.

Explore FAQs

Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. In Currency Trading For Dummies, you’ll find an everyman’s guide to participating—and profiting—in the currency markets. One of the key aspects of discipline in intraday trading is the development and adherence to a strict trading plan. If you’re bullish on a stock or ETF while not wanting to risk buying shares outright, consider purchasing a call option for a lower risk bullish trade. 8th Street Miami, FL 33199. 4 Current Liabilities. Get our latest economic research delivered to your email inbox. This is important as it allows you to execute trades at a favourable price. The blue line, XLK, was relatively strong compared with SPY. Account Opening Charge. Not only can you use it as a reference, but it’ll help you sound really smart at parties. You can lose your money rapidly due to leverage. I would also like to know your opinion about the Bitcoin era app and the BTC era app. When people talk about investing they generally mean buying assets to hold long term. Subscribe to our newsletter. Identify the major revenue and expense items that affect the net income. Available fractional shares trading. So, let’s cover the process of finding a trading strategy step by step. Revenues relating to the previous or https://pocketoptionono.online/ next year are not included. Options trading involves various factors such as strike price, expiration date, and option premium, which is the cost of the option contract. Elder points out that good trading is about strategy and decision making, not just profit.

Track Market Movers Instantly

When a user wants to send cryptocurrency units to another user, they send it to that user’s digital wallet. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. The motive of preparing a trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period. To smooth out that company specific risk, investors diversify by pooling multiple types of stocks together, balancing out the inevitable losers and eliminating the risk that one company’s contaminated beef will wipe out your entire portfolio. It is essential to identify the best intraday stocks while undertaking such investments, as it has relatively higher risks. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. All these apps are made for Android users. If ETFs are more your thing, check out the Best ETFs for Day Trading. Traders utilize these readings and price divergences to make informed decisions when entering options trades. Define your profit goals: It’s easy to get carried away by emotions in intraday trading. Stock trading app developers are constantly innovating and adding new features to make portfolio management easier to do on the go. Brokers like Charles Schwab, Fidelity, Robinhood, and ETRADE are well suited for swing and position traders because they provide a balance of research tools, user friendly platforms, and competitive prices, typically with commission free trading in most stocks and exchange traded funds. An internal hedge is a position that materially or completely offsets the component risk element of a non trading book position or a set of position. In the share market, it may mean risking a few cents a share in or order to make a few cents. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume as per CoinMarketCap. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Besides, instead of always using these long recovery phrases, Ledger Live allows you to set a 4 8 digit PIN, that lets you access your device quickly. It can be tricky to find your niche in the market. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. Technical analysis involves studying charts, patterns, and historical price data to predict future price movements. The following data may be collected and linked to your identity. Please check out our article about Sensibull Review to learn more about its features and benefits. If you have any questions about trading or investing. Book: Buffett: The Making of an American CapitalistAuthor: Roger Lowenstein. However, this is a leveraged form of trading options. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price.

Showing 0 of 5 selected Companies

The only thing he did not tell you was that it works similarly for losses also and they also tend to get magnified when you trade in futures. A plan is absolutely useless in the absence of the procedure of the audit of measurements and indicators of efficiency. A trader announced the execution of a transaction, writing it in a virtual room instead of using the email, and followers could read and reproduce the transaction. Option buyers must pay an upfront premium to the writers of the option. Originally developed by Thinkorswim Group Inc. Additional cryptocurrencies. While it can offer significant profits and flexibility for some, it’s high risk, time consuming, and not suitable for everyone. This doesn’t protect you from investment losses, but rather from the risk of investment firm failure. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Yes, StoxBox offers zero brokerage trading, allowing you to execute trades without paying any brokerage fees. Trade 26,000+ assets with no minimum deposit. Last Updated: June 27, 2024. If the MACD is below zero, it has entered a bearish period.

IPO

There mentorship support is really supportive and impresive. Use limited data to select content. This could be in the form of yoga, meditation, stretching, training, or just healthy habits. However, it’s essential to note that trend trading also has its drawbacks. At the outset of this strategy, you’re simultaneously running a diagonal call spread and a diagonal put spread. Our partners compensate us through paid advertising. It offers a vast library of historical data, technical analysis tools, and the ability to create custom watchlists. What is your opinion on the matter and how do you think we can we limit such loss. The concept of dabba trading is comparable to buying movie tickets in black. If they predict the stock’s price to rise, they buy “call” options. For long trades, a stop loss is often placed just slightly below a recent swing low and for a short trade just slightly above a recent swing high. Plan your entry and exit points in advance and stick to the plan. The forex market offers one of the highest amounts of leverage available to investors. This theoretical approach emphasizes the assessment of regular patterns in behavior, cognition, and emotional response. Measure advertising performance. This certificate lets you enjoy government trading benefits. Think stocks listed on indices like the FTSE 100, the top 100 largest companies listed on the London Stock Exchange, for example. For example, if you live in the U. The value of your investments may go up or down. The current urban fabric construction and fire safety needs, force the need for Firefighting and safety equipment. They should also check the fee and pricing structure of a particular trading app, its new age features, payment options,, and safety protocols. When to use it: A long put is a good choice when you expect the stock to fall significantly before the option expires. Do you have the time and dedication to be a day trader or would swing or position trading be more suitable for you. Other fees may creep up — most commonly, brokers tend to charge contract fees to trade more complex investments like options, and there may be fees to transfer investments out of your account. The following paragraphs refer to the European EPEX Spot.